WHY SYSTEMS FAIL, AND IT IS REALLY NOT ABOUT MONEY

A winter lockdown forces us all to examine our domestic interiors, with in my case perhaps a superfluity of paper, which led me to “Fiasco”, by Thomas E. Ricks. It is a seminal description of how complex systems create monsters and then fail, not for lack of effort, nor goodwill, nor money, but from thrashing about with no coherent strategy.

Indeed, arguably all those three inputs make matters worse. The tale simply told, in a largely deadpan tone, is of the greatest failure of American foreign policy since Pearl Harbour, and the greatest crime perpetuated by a British Prime Minister, since the Bengal Famine. It is how Bush, looking for revenge after 9/11, has spawned the disasters of the modern Middle East and locked us all into an unending cycle of terrorism and for the millions of people in the Middle East and beyond, brought poverty and despair.

Strategy matters

How? Well as Ricks tells it, they used the wrong tool for the wrong job: the strategy was hazy, mission creep endemic, the reporting system mangled everything to suit those making the reports. In the meantime, the aims kept shifting, and staff rotation and comfort swamped the original purpose of simply executing the mission.

While those they were sent to save, service and otherwise succour, were embittered and made hostile by the sacrifices they were expected to make, in return for specious, obscure propaganda.

So that led to the USA seeing the Iraqi people as the enemy, not just their crazed leader, while the entire Iraqi government was blamed for funding and concealing these non- existent weapons. Read it. Because from that flowed the failure of Phase IV (the post conflict reconstruction), the hostile occupation (not liberation) of Iraq, the idiocy of making that occupation subservient to Pentagon (not civilian) demands, the destruction of the fragile sectarian balance between Shia and Sunni, the rise of ISIS, the Syrian nightmare, Yemen, and the Iran nuclear programme.

Meanwhile, the attendant loss of money, the coming to power of the isolationist and militia based right wing in the US, the triumph of China in the emerging world, the resurgence of Russian thuggery all remorselessly followed on. Simply unbelievable. As Hicks writes it, you can hear the quiet click, as the lid of Pandora’s box was ever so gently released; beats bat breeding labs in Wuhan for the sheer laconic horror of it.

They did start the fire.

I do not know what the Pope going to Baghdad shows, beyond a startling personal courage, but it is no ordinary trip. The story also shows how in the modern world massive complex heavily manned delivery systems just can’t operate. They are dinosaurs. There was nothing inherently wrong with the US Army, but yet it created its own defeat.

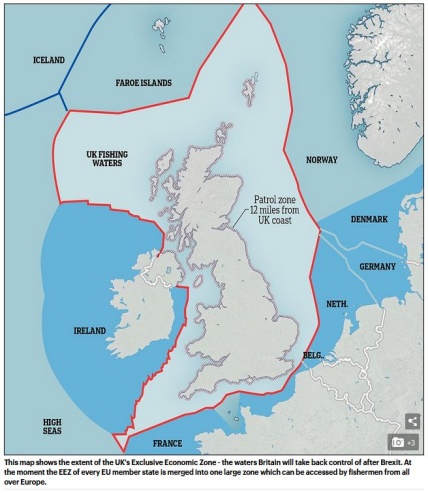

WHY THIS SYSTEM WILL FAIL TOO, AND AGAIN, IT IS NOT ABOUT THE MONEY

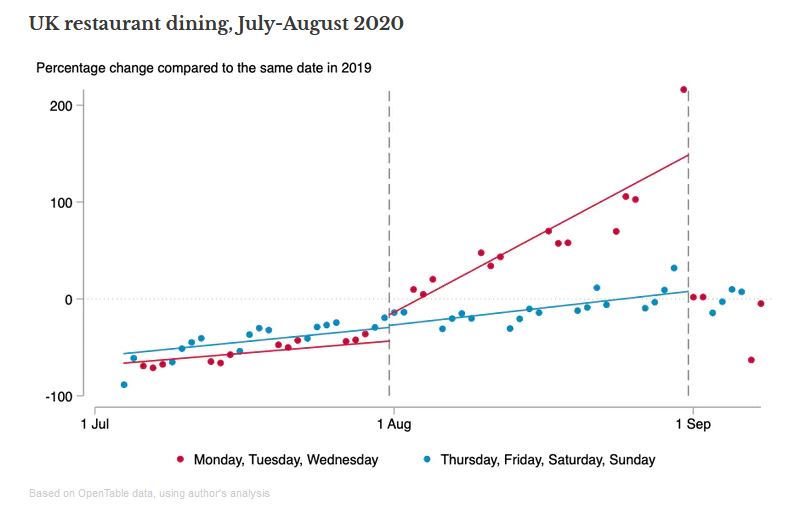

So, to the UK budget, another set of tactical responses to poorly understood problems, hemmed in by contradictory rules, horribly distorted by politics. Sadly, the government really does believe it is the presentation that matters, not delivery. So, we had Rishi, spooling out unending largesse, and crudely claiming he was going to level with us, and level up North Yorkshire, and hand out freeport concessions to his chums and give Ulster another £5m for their paramilitaries (oh, you missed that one?).

A more extensive piece will shortly be on our website. It questions whether we are building back better. To me this looks more like ‘business as usual’, no growth, no decent jobs, London’s supremacy ploughing on, the regions thrown scraps. Green? When you freeze vehicle fuel prices for the eleventh year? Hardly. So yes, the budget was a relief, but no it should not have been. I doubt if markets will like it much, just because the publicans do.

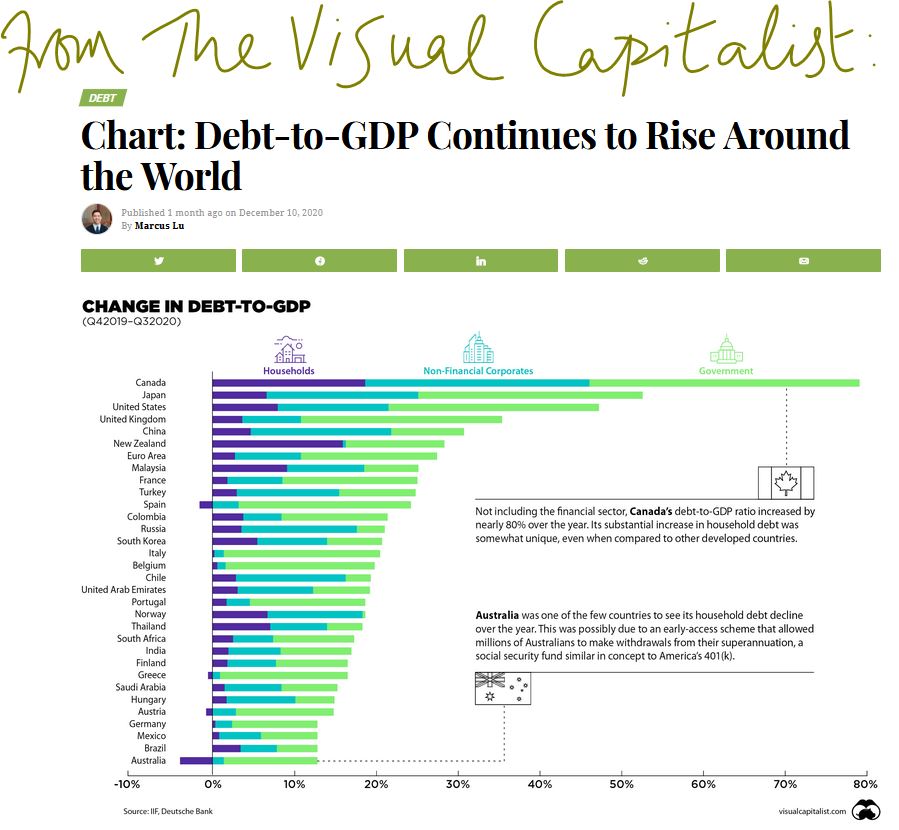

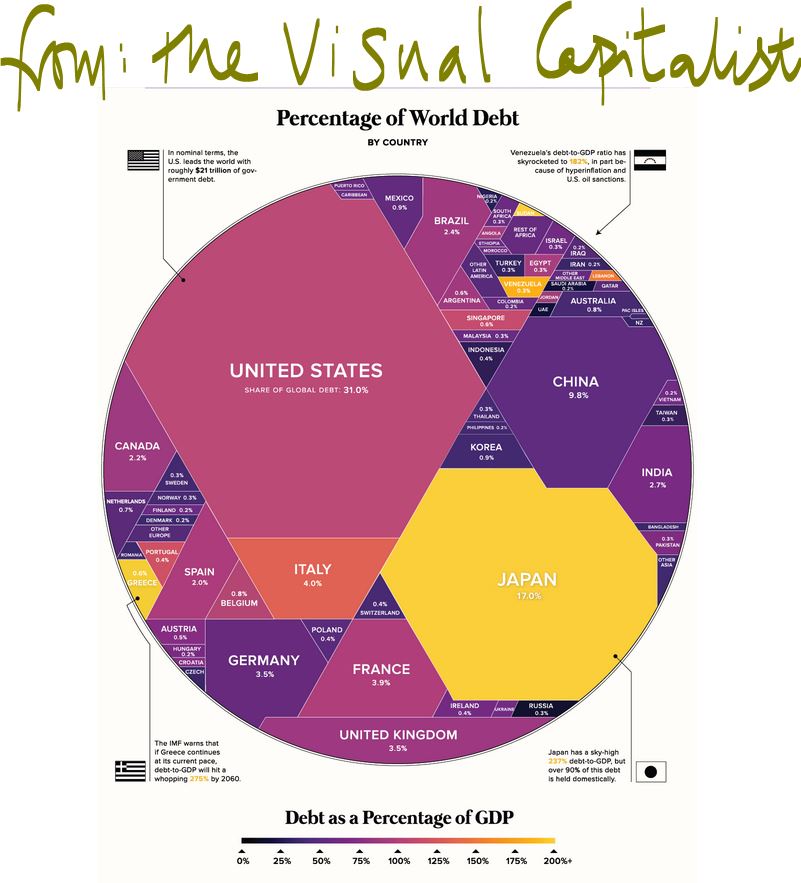

DEBT AND EQUITY MARKETS AND INTEREST RATES

Markets Well, there is another puzzle, I thought the august President of Queens’ College Cambridge was going to self-combust into his tache, such was his thrill at seeing the bond vigilantes shooting up the US ten-year interest rate, during the week. Biden must pay his electoral base the bribe needed to win those Georgia Senate seats, at the full inflationary excess of $1.9 trillion, pumped onto an economy that is already visibly and dangerously overheating. The one Game Stop we do need, won’t happen.

So, you have $27 trillion and rising of outstanding US government debt, do the maths, if the bond vigilantes push rates up by 1% for the average duration of that debt, 65 months, that will cost you some $1.5 trillion back. So sure, you can cough up on your election pork, but it will cost the American people $3.4 trillion to do that.

Well, we don’t actually think that attempted rate increase can stick, for all the reasons it failed to stick over the last decade. Powell at the Fed then agrees with us, which on past form is perhaps an ominous sign of our approaching error (or possibly his gaining of wisdom).

Equity markets certainly felt unhinged; they started to whipsaw around in a frankly worrying fashion. On prior performance this does need sorting out, before it is safe to go back in. If (of all places) the US will lead on raising rates, it has to then pull up all other global interest rates, which we know will slow growth and take the wind out of the recovery. Indeed, it may threaten it, it has to cut (see above) how much governments can then borrow, has to start foreign exchange rates jockeying for position, has to question the whole free money basis of tech valuations.

I simply don’t think this recovery and these valuations can stand that just yet, and after a decent pause, the Fed (like many other Central Banks do already) will have to act to somehow hold down rates. Whatever Governments say, money does have a time value, and behaving as if it does not, is rather unwise. But I think extend and pretend will still persist for a while yet.

Charles Gillams

Monogram Capital Management Ltd